Data from the 2020 population census showed that in the past decade.

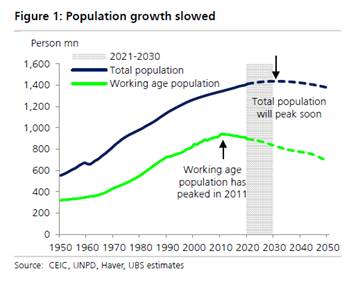

China’s population growth slowed and aged further though China managed >7% annual growth. China’s population is expected to peak in the next decade, with working agepopulation shrinking by another >60 million and average age rising further.

“However, we believe additional rural labor transfer and extension of retirement age can help generate positive non-farming employment growth, supporting an average annual GDP growth of >4.5% for the 2020-2030 period,” says Dr Tao Wang, Head of Asia economics and Chief China economist of UBS Global Research.

“We expect the government to relax population policy further. Most important and likely policy change may be the extension of retirement age, as the current average retirement age is below 55. An extension of 3 years could add >60 million people to the labor force.,” she added.

Tao continues to expect faster growth in automation equipment, robotics, and acceleration in digitalization. Health care, old-age care and asset management businesses should gain more importance in the next decade.

Macro Keys: China’s Demographic Challenges in the Next Decade

Population growth slowed and aged further…

Data from the 2020 population census showed that in the past decade, China’s population growth slowed further to 0.53% a year, average age of the population rose to 38.8, and working age (15-59) population shrank by 40mn. On the positive side, average years of education for the labor force increased by >1 year, and urbanization advanced further with >900mn people living in cities, especially in the Eastern region.

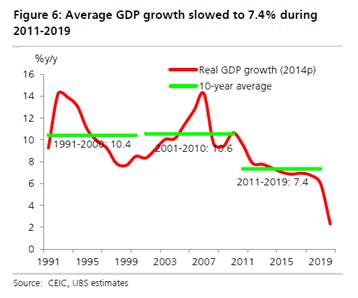

…though China managed >7% annual growth

As we had predicted, continued labor transfer from rural areas helped to generate >2% non-farming employment growth, contributing to 7.4% of annual GDP growth in the 2011-2019 period. Labor productivity grew robustly in the industrial sector, though labor-intensive sectors lost some market shares while high value-added ones such asmachinery gained. Since demographic trends move slowly, saving rate dropped onlymodestly and pension system still accumulated surpluses in the past decade. Propertyinvestment continued to grow, albeit more slowly than in the previous decade.

Bigger challenges ahead, but annual GDP growth to exceed 4.5%

China’s population is expected to peak in the next decade, with working age population shrinking by another >60 million and average age rising further. However,

we believe additional rural labor transfer and extension of retirement age can helpgenerate positive (albeit slower) non-farming employment growth, while better

education and vocational training should improve human capital, both supporting anaverage annual GDP growth of >4.5% for the 2020-2030 period.

Structural shifts in the economy to continue

Labor-intensive sectors will likely face further cost pressure while we see faster growth in automation equipment, robotics, and acceleration in digitalization. As income growsfurther and population ages, we expect China’s consumption pattern to shift furthertowards services, especially health care. As more people save for old ages, corporate and private pension plans and asset management industries should see greater growth.

Likely policy changes in the coming decade

We expect the government to relax population policy further, though subsidies for childbirth seem unlikely. Most important and likely policy change may be the extension ofretirement age, as the current average retirement age is below 55. An extension of 3years could add >60 million people to the labor force. To address the upcoming funding gap of the current pension system, we think the government may redefine pension benefits, encourage private and corporate pension plans, tighten local government debt management, and increase SOE divestment.

Implications for asset prices

At the macro level, we expect to see weaker long term growth and increasing need tosave for retirement to keep interest rates from rising over the long term. At the sectorlevel, labor-intensive manufacturing will likely face the pressure of rising labor cost, either moving to cheaper places or quicken the pace of automation. Services sectors including e-commerce that relies on cheap labor will also likely be affected. The negative impact of stagnating or shrinking population on the urban property market may be cushioned by continued (albeit slower) urbanization and the continued decline in household size. We continue to expect faster growth in automation equipment, robotics, and acceleration in digitalization. Health care, old-age care and asset management businesses should gain more importance in the next decade.

The much anticipated population census data was released. Not surprisingly, China’s population growth continued to slow even as the country fully relaxed the one-child policy in 2015. The latest census data also showed that total fertility rate had dropped to 1.3% in 2020, the share of people aged 60 and above had increased to 18.7%, and the average age of the population had increased 38.8 in 2020. These data have increased the concerns about China’s future trend growth and other challenges brought by an aging population. Some pessimists are calling this a population crisis leading to grave economic consequences.

Before we analyse the implications on different sectors and asset prices, it is important to note that demographic trends tend to happen gradually over a long period of time, and their impact on macro- economic indicators are often influenced by other key variables, such as macroeconomic policies and technological evelopment.