New Climate Requirements aligns more closely with IFRS S2, to be effective from 2025 reporting year in phases

The Stock Exchange of Hong Kong Limited (the Exchange), a wholly-owned subsidiary of Hong Kong Exchanges and Clearing Limited (HKEX), today (Friday) published conclusions to its consultation on the enhancement of climate-related disclosures under its environmental, social and governance (ESG) framework (Consultation Conclusions).

The Exchange received 115 responses from a wide range of respondents, and received broad-based support for its proposals to introduce the new requirements. In view of this market feedback, the Exchange will adopt its consultation proposals.

In reaching its conclusions, the Exchange took into account the Hong Kong Government’s vision and approach towards developing a comprehensive ecosystem for sustainability disclosure in Hong Kong and the International Sustainability Standards Board’s (ISSB) jurisdictional guide preview. The Exchange will modify its proposals to reflect IFRS S2 Climate-related Disclosures (IFRS S2) more closely, as set out in the Consultation Conclusions (New Climate Requirements).

“With a strong market mandate, we at HKEX are pleased to be among the world’s first exchanges to enhance the climate-related disclosure requirements based on IFRS S2. We are also adopting a phased approach and implementation reliefs to support listed companies to meet the new requirements without undue burden and within a reasonable timeframe,” said Katherine Ng, HKEX Head of Listing.

“The New Climate Requirements form part of the wider Hong Kong roadmap for the local adoption of the ISSB Standards4. This will be an important part of our ongoing efforts to prepare listed companies towards eventual sustainability reporting in accordance with the local sustainability disclosure standards under development, enhancing Hong Kong’s capital markets attractiveness and competitiveness,” added Ms Ng.

The key features of the New Climate Requirements are as follows:

- The New Climate Requirements are developed based on IFRS S2. Implementation reliefs including proportionality and scaling-in measures are introduced to address concerns over the reporting challenges that some issuers may face.

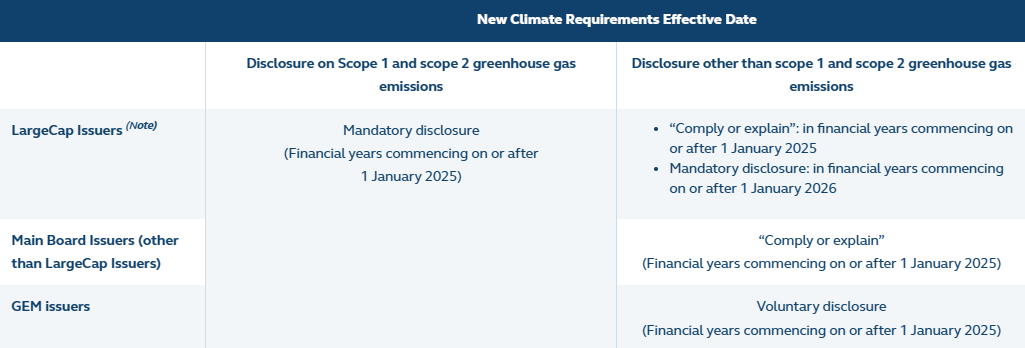

- The amended Listing Rules will come into effect on 1 January 2025.A phased approach is adopted for the implementation of the New Climate Requirements as follows:

The Exchange has also published guidance (Implementation Guidance) to assist issuers’ compliance with the New Climate Requirements. The Implementation Guidance contains references to the relevant principles in IFRS S1, and issuers are encouraged to refer to and apply the Implementation Guidance when preparing disclosures under the New Climate Requirements.

Notes:

- The consultation paper was published on 14 April 2023. The consultation period ended on 14 July 2023.

- In March 2024, the Hong Kong Government’s Financial Services and the Treasury Bureau published a statement setting out the vision and approach of the Government and financial regulators towards developing a comprehensive ecosystem for sustainability disclosure in Hong Kong. In particular, the Government will work with financial regulators and stakeholders to develop a roadmap on the appropriate adoption of the ISSB Standards, and the Hong Kong Institute of Certified Public Accountants (HKICPA) will assume the role of the sustainability reporting standard setter in Hong Kong to develop local sustainability reporting standards aligned with the ISSB Standards.

- In February 2024, the IFRS Foundation published the preview of the inaugural jurisdictional guide for the adoption or other use of the ISSB Standards.

- Refers to IFRS S1 General Requirements for Disclosure of Sustainability-related Financial Information (IFRS S1) and IFRS S2 Climate-related Disclosures (IFRS S2) published by the International Sustainability Standards Board of the IFRS Foundation.