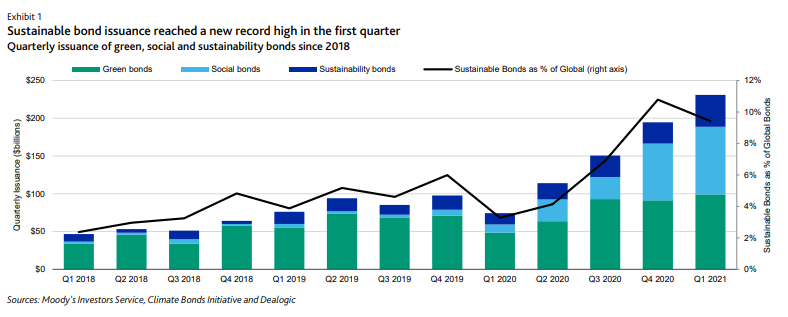

Global issuance of green, social and sustainability bonds – or sustainable bonds, collectively – totalled a record $231 billion in the first quarter of 2021, a 19% increase over the previous quarter and more than three times higher than the same quarter last year, Moody’s Investors Service says in a new report.

“Sustainable bond volumes are surging this year given strong sustained interest among debt issuers and investors,” says Matthew Kuchtyak, AVP-Analyst in Moody’s Investors Service’s ESG Group.

“A heightened level of governmental policy focus on climate change and sustainable development globally will also spur further market growth and harmonization.”

The $231 billion first quarter total was comprised of record quarterly volumes from each of the three segments, including $99 billion of green bonds, $90 billion of social bonds and $42 billion of sustainability bonds.

Sustainable bonds represented 9.4% of global debt issuance in the first quarter, the second-highest quarterly share on record, and will likely fall in line with Moody’s expectation for an 8-10% share of total issuance in 2021. The combined green, social and sustainability bond market is on pace to surpass Moody’s forecast of $650 billion for all of 2021.

Debt issuers also continue to raise their focus on sustainability-linked bonds and loans. Sustainability-linked bonds jumped 57% to a new quarterly high of $8.6 billion, and should grow as issuers seek access to sustainability-minded investors while maintaining the flexibility of general corporate purposes borrowing. Sustainability-linked loans hit $97 billion in the first quarter, 29% higher than the previous record from the fourth quarter of 2020.

The rapidly evolving policy and regulatory landscape is placing sustainable finance top of mind and will further support sustainable bond growth. Governments globally are increasingly pursuing policies that will lead to more rapid decarbonization and green infrastructure investment, gradual clarity around the criteria for activities to be considered sustainable, and greater international collaboration around sustainable finance initiatives.