Growing awareness on the relationship between ESG criteria and financial returns has made disclosure on how companies manage their ESG risks more crucial – to enable investors to make informed decisions.

However, the exact mechanism behind performance in ESG related areas and financial outcomes remains unclear even if there is evidence for a relationship between the two.

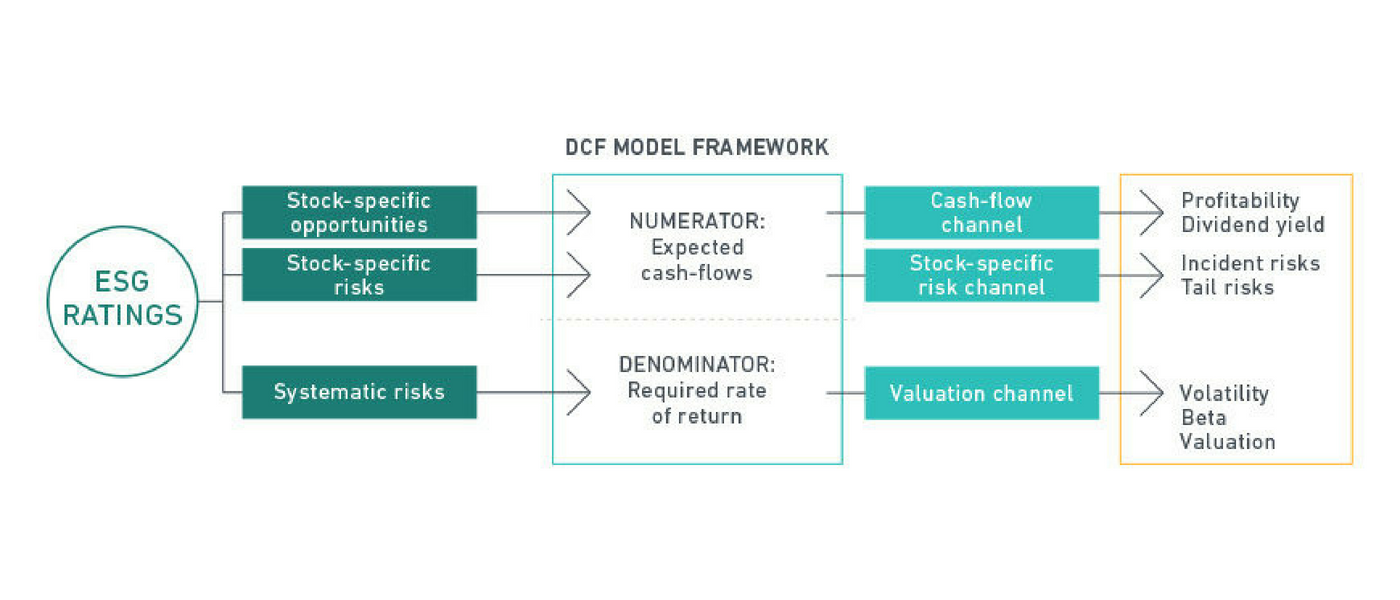

A research paper by MSCI Inc., a renowned provider of research and insights for institutional investors, has attempted to highlight the “link between ESG information and the valuation and performance of companies, both through their systematic risk profile (lower costs of capital and higher valuations) and their idiosyncratic risk profile (higher profitability and lower exposures to tail risk).” The aim of the paper is to analyse the various transmission channels from ESG to financial performance in order to provide a fundamental understanding of how ESG characteristics affects corporations’ valuation and risk.

Two idiosyncratic risk and one systemic risk transmission channel was identified, namely: cash flow channel, idiosyncratic risk channel and valuation channel.

The economic rationale behind the channels are as follows:

1.Cash flow channel- High ESG rating companies are more competitive due to more efficient use of resources, human capital development and better innovation management. This leads to abnormal returns – higher profits and higher dividends.

2.Idiosyncratic risk channel- High ESG rating companies tend to better manage risk and have better corporate governance standards. Less frequent outbreak of risk incidents leads to a lower tail risk in the company’s stock price.

3.Valuation channel- High ESG rating companies are less vulnerable to systematic market risks such as commodity prices. Lower systematic risk means investors demand a lower required rate of return. This implies a lower cost of capital which translates to a higher valuation.

An examination of the causality in the systemic and idiosyncratic risk channels, led to the conclusion that ESG downgraded companies experienced a relative increase in both systematic and stock-specific risk compared to companies whose ESG rating was upgraded.

Finally, they provide empirical evidence for a causal relationship between ESG and financial performance by looking at the extent to which changes in ESG ratings predicted changes in financial variables. They found that the ESG rating change may be a useful financial indicator, which was termed as ESG momentum.

It was observed that an improvement in ESG characteristics led to increase in valuation over time. Thus, ESG ratings and ESG momentum are both financially important indicators which can be used for portfolio or index construction. The effects of changes in ESG initiatives are long-term and take time to realise.

Most importantly, the paper provides evidence that ESG ratings have a financially material impact on valuation, profitability and risk and should be taken into account in financial analysis.