HKEX issued a Consultation Paper on April 14, 2023, proposing amendments to its ESG reporting framework. The proposed changes would require issuers to include climate-related disclosures based on the ISSB Climate Standard in their ESG reports, shifting from the current “comply or explain” approach.

The consultation period concluded on July 14, 2023, and a total of 115 submissions were received from various stakeholders. Among the respondents, 79% expressed support for the proposal, while 21% opposed it.

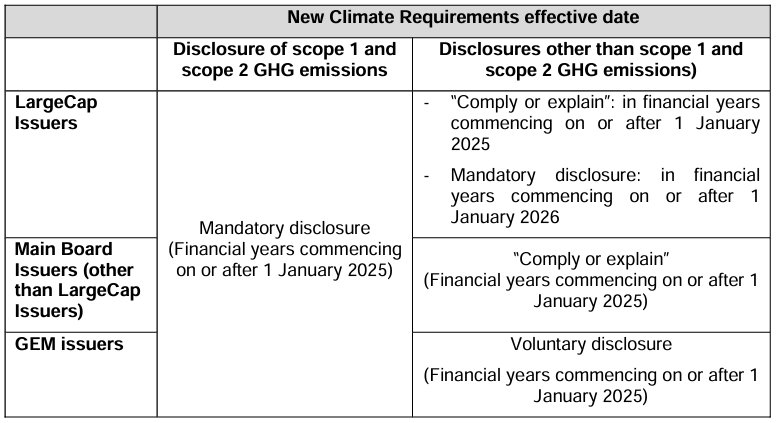

HKEX will implement a phased approach that mandates issuers to report on the New Climate Requirements in the following manner:

Source: HKEX’s Enhancement of Climate-related Disclosures under the ESG Framework

Proposed Interim Period Removed

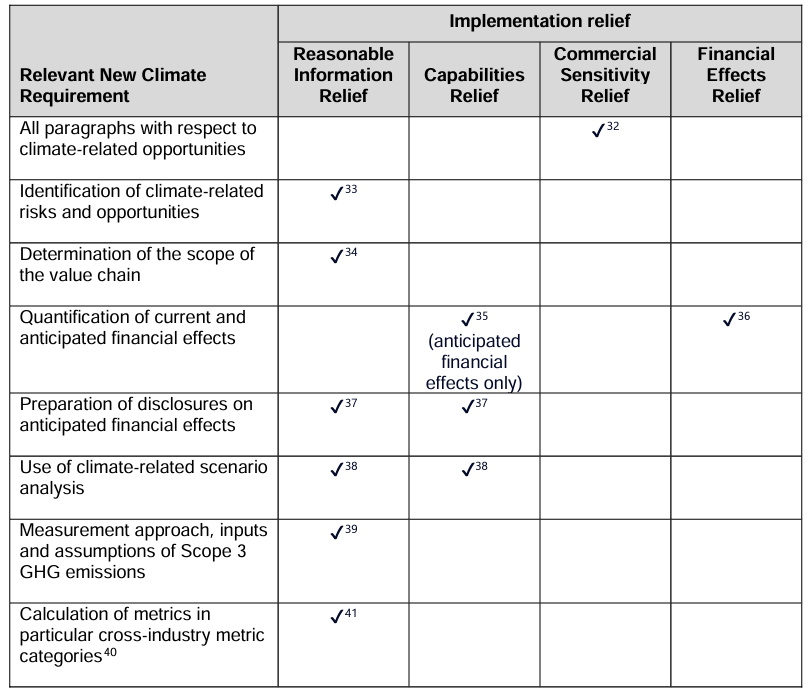

The new climate disclosure requirements largely align with the ISSB S2 standards. HKEX has decided to eliminate the interim period and instead offer implementation reliefs, where applicable, to address concerns related to reporting challenges faced by certain issuers due to limited resources or technical expertise. The table below provides a summary of the New Climate Requirements along with the availability of implementation reliefs.

Source: HKEX’s Enhancement of Climate-related Disclosures under the ESG Framework

Materiality –

“Materiality”, under the ESG Code, is not confined to financial materiality. This means that an issuer’s board may determine that an ESG issue is material on grounds other than its impact on the company’s financial performance or financial position. HKEX stated in the conclusion that it will not change the scope of the “materiality” reporting principle under the ESG Code. Issuers are, therefore, also allowed to prepare disclosures for the purposes of the New Climate Requirements under the double materiality approach to provide additional disclosures to meet the need of its stakeholders.

For the purpose of the New Climate Requirements, an issuer must disclose information about climate-related risks and opportunities that could reasonably be expected to affect its cash flows, its access to finance or cost of capital over the short, medium or long term.

Financial Effects

For both current and anticipated financial effects, issuers are required to disclose both quantitative and qualitative information, and quantitative information may be expressed in a single amount or a range. To address concerns over the practical challenges of quantifying climate-related financial effects, issuers need not provide quantitative information about the current financial effects of a climate-related risk or opportunity where certain conditions are met stipulated in the Financial Effects Relief

Impact on financial reporting: Where the effect of climate-related risks or opportunities is material, such an effect should also be accounted for in financial statements prepared in accordance with the relevant accounting standards. Issuers should also consider disclosing such climate-related financial effects in their annual reports in addition to the ESG report.

HKEX allows non-disclosure of quantitative anticipated financial effects if an issuer does not have the skills, capabilities or resources to provide that quantitative information

GHG Emissions

Scope 1 and 2: All listed issuers are required to disclose scope 1 and 2 GHG emissions on a mandatory basis, using the location-based method.

Impact on financial reporting: Disclosure of scope 1 and scope 2 greenhouse gas emissions for the consolidated accounting group and other investees separately is encouraged but not mandatory. For Scope 1 and 2 GHG emissions, if the emissions for unconsolidated investees are included in the issuer’s GHG emission inventory, IFRS S2 requires disclosure of Scope 1 and 2 GHG emissions to be disaggregated separately for (a) the consolidated accounting group, and (b) other investees excluded from (a) (e.g. associates, joint ventures and unconsolidated investees for issuers applying IFRS Accounting Standards) Issuers are encouraged to follow such requirement under IFRS S2. (See p.83 of Implementation Guide).

Scope 3: Issuers are required to disclose scope 3 GHG emissions, including in-scope categories of significant upstream or downstream categories and basis of selection. Under the implementation reliefs, HKEX allows issuers to measure GHG emissions using information for reporting periods that are different from its own reporting period, subject to certain conditions.