The idea of environmental, social and governance (ESG) was first introduced in markets in 2005 in the backdrop of a landmark study called “Who Cares Wins”. With the unexpected hit of the pandemic, sustainability has become one of the key global concerns for investors, businesses and governments.

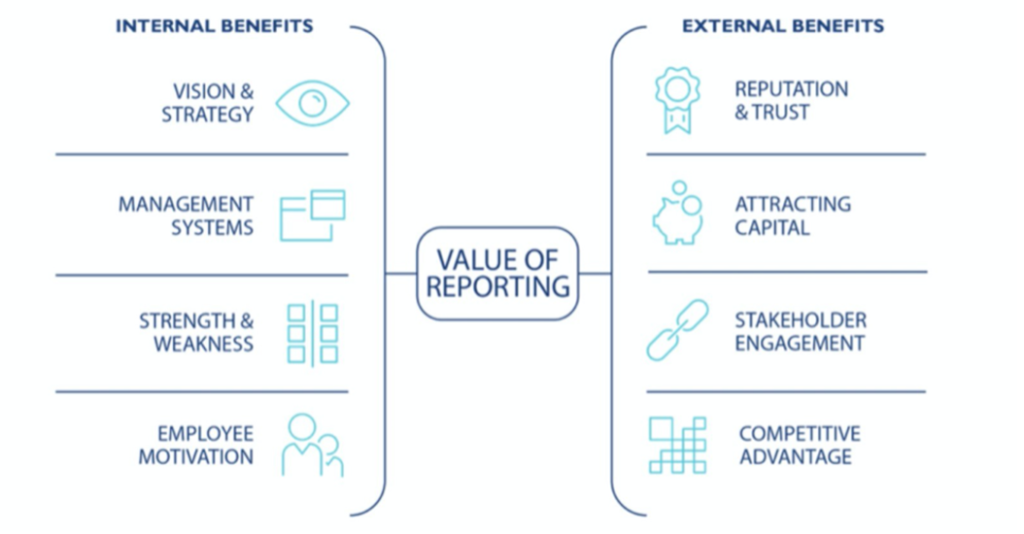

The ESG report of a business can now be considered as a portfolio of its sustainability and ethical approach and actions. It provides an overview of how a business responds to climate change, how it builds trust and bolsters innovation, how it treats its workers and how it manages its supply chains. Being part of the whole sustainable development agenda, ESG reporting covers a wide range of issues that allow a business to reflect upon its relationship with different stakeholders, including the society, its employees and the environment, while reinforcing the values the organisation wishes to follow and inculcate in its employees.

Source: Small Business Big Impact SME Sustainability Reporting from Vision to Action p.3

With sustainability becoming a major consideration for investors and corporates, many organisations are making ESG disclosure mandatory for businesses. For example, the Sustainable Finance Disclosure Regulation (SFDR) by European Commission imposes mandatory ESG disclosure obligations for financial markets participants effective since March 2021. While in 2019, HKEX has introduced amendments that make ESG reporting mandatory for listed companies.

Despite different policies being designed and implemented, the sustainability reporting system is yet to be fully matured. Currently there are varying international reporting standards. Clarity, transparency and consistency have become major concerns as the world lacks a comprehensive and mandatory reporting system. Recently, efforts at unifying reporting standards have been made by different sustainability standard-setting organizations e.g., CDP, CDSB, GRI, IIRC and SASB, who are trying to provide coherence and effective information for the public.

Transition to Net-zero

In addition to the global shift in prioritising sustainability, the market attention has moved to achieving net zero carbon. The latest 2021 IPCC climate report reflects the harsh reality of acceleration of climate change. The threshold of 1.5°C global warming is coming perilously close which means strong, sustained and rapid efforts are needed to reduce greenhouse gases emissions, to stabilize the climate and reach net zero carbon emissions.

To achieve carbon neutral status, a combination of carbon offsetting and emissions reduction is required. In fact, the efforts in achieving carbon neutrality can be considered as part of a company’s response to climate change. For example, increasing the share of renewables such as solar, hydro, wind or biomass energy in a company’s energy mix developing or using sustainable and recyclable materials in production process can help reduce carbon emissions. Individuals can also help realise the net-zero goal by changing their living and eating habits to more sustainable ones. An individual can reduce his/her carbon footprint by as much as 80% by moving to a vegan diet.

Global and governmental cooperation is also an important element in reducing carbon emissions. The Paris Agreement is a pioneering example of international commitment to achieve carbon neutrality. For example, China has committed to reach carbon neutrality by 2060 while Hong Kong aims to do so by 2050. Apart from international treaties, other regulatory cooperation such as the European Green Deal, backed by the European Climate law, aims to achieve carbon neutrality in Europe by 2050. Government and policy-makers should be the first to take initiatives as they often form the very basis of regulatory frameworks for the rest to follow.

Managing risks

Yet, with changes in public policies and regulations, the journey to carbon neutrality can lead to a non-physical risk called carbon asset risk. In a world with rapid information flow and technological evolution, markets are becoming more unpredictable. The changing dynamics between legal, technological and economic factors affect companies and institutions in their decision-making processes.

The operational and financial viability of carbon assets are dependent on policies, choices of technology and the costs can be affected by technological developments and changes in the economy and markets e.g., fossil fuel prices can have negative impacts on companies that own the assets. Many of these carbon risk factors are intertwined. Risk evaluation and assessment are needed to mitigate or prevent losses. In fact, these all bring us back to ESG, where evaluation of carbon risk exposure is one of the components of the analysis.

It is irrefutable that humans have the greatest influence over the past and the future climate. Sustainability is no longer a vision but an urgent material topic that needs to be acted upon by everyone. Global cooperation and evaluation is the key to successful sustainable and ethical management.