According to the findings from Bain & Company and The Hong Kong Chartered Governance Institute joint report on Hong Kong Boards entitled ‘The New Board Agenda’ released today, over 90% of the senior management of companies surveyed expecting more turbulence in the business environment in the coming 3-5 years. Large corporates who run regional or global business footprints expect even more intense risks. Over 1,400 members of senior management of companies, in Hong Kong and Mainland China, participated in this survey. Throughout the growing turbulence, the report finds that there has been a shift towards managing companies in the long-term interests of a broad set of stakeholders. The collective research shows that boards that have discussed stakeholder management are better at managing turbulence in all dimensions.

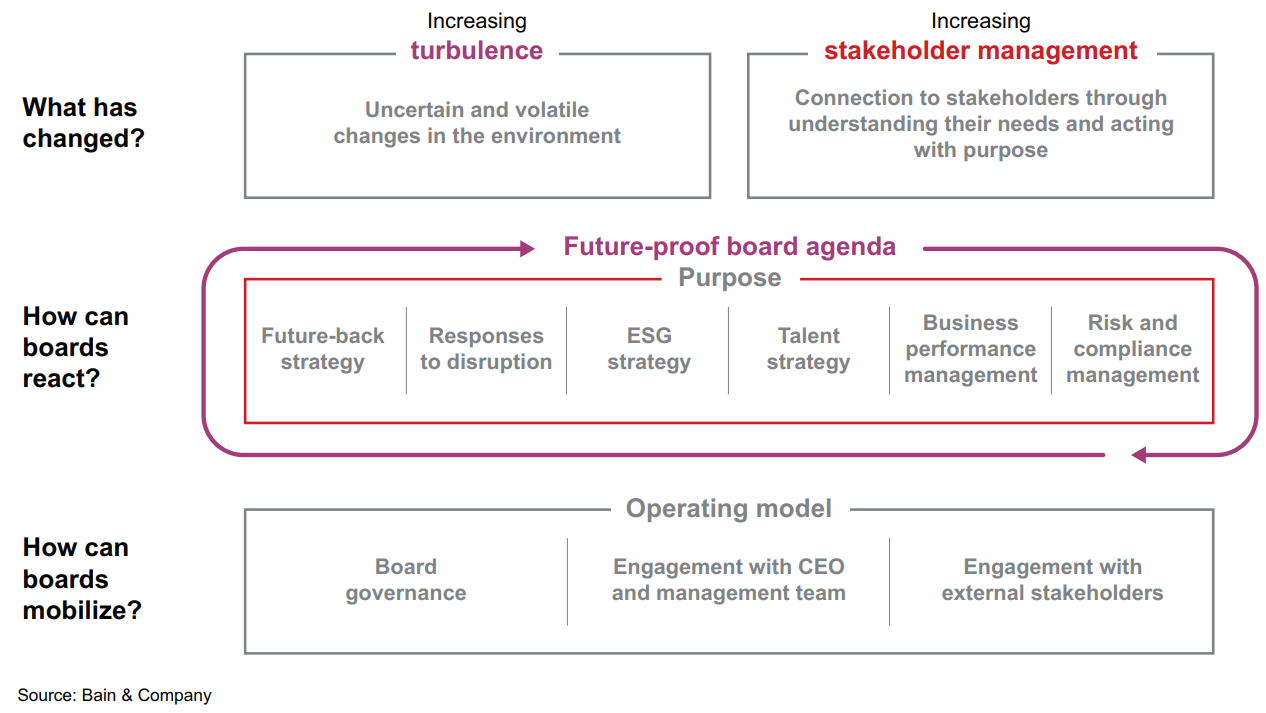

Boards can respond with a future proof agenda, focusing beyond the firm’s strategy and risk topics, through stakeholder management, including in the following areas:

– Future proof strategy: By focusing on the few uncertainties that matter most to stakeholders, boards can begin to develop a vision for the future that addresses potential concerns. They can then build a portfolio incorporating appropriate resource planning.

– Environmental, Social, and Corporate Governance (ESG): By ensuring regular discussion of ESG, boards can integrate an ambition for sustainability into the company’s core strategy, setting specific goals with clear action plans.

– Disruption: Boards can identify opportunities to win by considering how to respond to potential disruptions, including new consumer demands, ecosystem evolutions, data analytics, new capabilities, and emerging competition.

– Talent: The best talent strategy ensures that the right talent is in the right roles at the right time by assessing talent gaps and identifying key talent requirements. Successful strategies also include guidelines for mobilising talent.

– Performance management: Boards can build financial strength to fuel growth and innovation by achieving operational excellence through cost transformation, agile corporate support, procurement optimisation, and supply-chain resilience.

– Risk and compliance: A clean-sheet approach to compliance re-examines the root cause of compliance failure and organisational complexity and identifies which activities are truly needed, who should perform them, and how they should be performed. It also eliminates nonessential tasks, thus reducing complexity and risk.

While within Hong Kong, companies are generally confident about their ability to manage turbulence, only 50% of boards have discussed about stakeholders and how to manage them. And then only 1 out of 5, or 20% of the boards regularly discuss stakeholder issues in board meetings and strongly agree that they know who their relevant stakeholders are. Even then, only half of these boards, or 10% of the boards surveyes, believe they are meeting the right balance between stakeholder and shareholder interests. As over 90% of the respondents, comprising directors, company secretaries, and other senior management in Hong Kong recognise the positive impacts of effective stakeholder management, there is room for improving on actual stakeholder actions in view of the survey findings.

“Currently, Strategy and Risk are the most common topics on Board agendas, with leadership succession and stakeholder management the least discussed,” explained Mr. Chang. “It is important to note that 17% of company secretaries are already very involved in proposing topics and shaping the board agenda, a number which will need to increase in order to ensure company’s ability to weather through turbulence, and the company secretary as governance professional, should seize on the opportunity to do this.” said Gillian Meller FCG FCS(PE), President of The Hong Kong Chartered Governance Institute. By adopting a future proof board agenda to address turbulence and stakeholder concerns, firms in Hong Kong can protect themselves from potential issues arising. Evolving board governance, engagement with the leadership team, and engagement with stakeholders will prove to be key for these measures to be successful moving forwards.