The recent proliferation of net-zero targets among governments and the financial sector

– coupled with the increasing focus on disclosure around the risks of climate change – is expected to raise credit risk and reduce the availability, and increase the cost, of capital for carbon-intensive activities. In consequence, we expect pressure to inexorably rise for major producers and users of hydrocarbons to adjust business strategies to implement credible transition plans. We expect the impact will be more significant than the limited effect to date of patchwork policy implementation, gradual changes in disclosure requirements or moves by investment funds to reduce their fossil-fuel holdings. However, the full implications for this decade of such initiatives will only become clear with the detail, breadth and speed of implementation steps taken under the net zero initiatives.

Major economies’ emissions reduction goals are converging

The Biden administration Climate Summit of last week confirmed that a major convergence and acceleration in global policies to reduce emissions is under way – reinforcing the expected implications of President Biden’s reversal of his predecessor’s decision to withdraw the US from the Paris climate agreement, (see 2021 outlook – Stimulus, transparency and policy alignment to amplify ESG trends).

One of the most important elements of any net-zero plan is the critical initial step to set the entity on the right path and make it easier in the long term to achieve net zero. For governments, this takes the form of end-of-decade targets, and more commitments are expected as preparations continue for the United Nations Climate Change Conference (COP26) in Glasgow in later 2021. The recent Biden climate summit saw the following 2030 policy developments in major economies, building on those already made:

- » The US has confirmed a 2030 target of reducing greenhouse gas emissions by 50%-52% from 2005 levels.

- » The European Union has formally adopted its “Climate Law” to cut greenhouse gas emissions by at least 55% by 2030 from 1990 levels.

- » Chinese President Xi Jinping has indicated that coal use will peak by mid-decade and be phased down under the country’s 15th five-year plan (2026-30).

- » Japan has revised its greenhouse gas emissions target and is now aiming for a 46% reduction by 2030 from 2013 levels, a far more ambitious goal than its previous target of a 26% reduction.

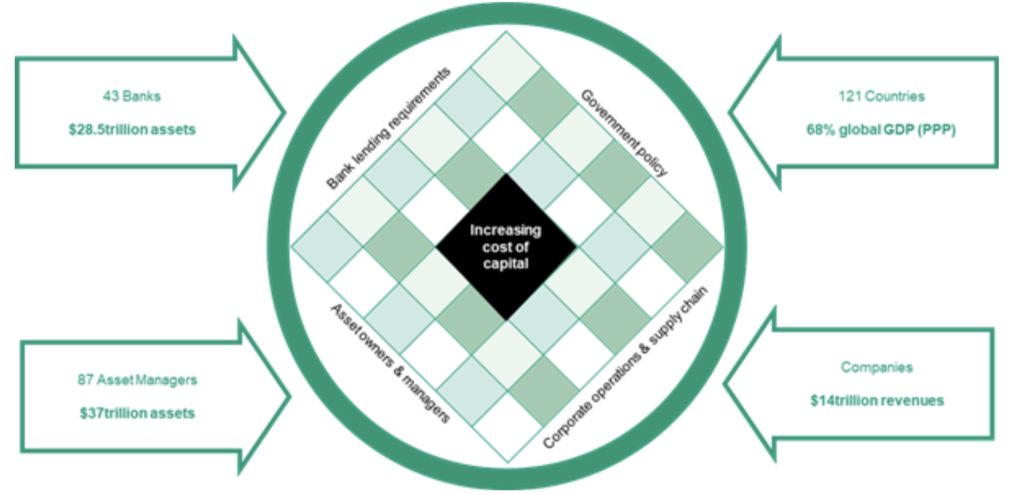

In terms of government commitments, the United Nations estimates that 121 countries, 23 regions and 509 cities – representing 68% of global GDP – have now signed up for the “Race to Zero” initiative. This initiative aims to mobilise all actors to build momentum around decarbonisation.

More financial institutions are embracing net-zero

Compounding the implications of policy shifts are the initiatives underway, in the run up to COP26, to coordinate a critical mass

of meaningful financial sector net-zero commitments under the Glasgow Financial Alliance for Net Zero (GFANZ) initiative. These financial sector initiatives, if followed through on, will require meaningful changes in portfolio investment and lending practices by the end of the decade for those who are signatories.

Net-zero initiatives in the finance sector include the following:

- » The Net Zero Asset Owners Alliance, a group of 37 institutional investors with $5.7 trillion under management, has committed to transitioning their investment portfolios to net-zero emissions by 2050.

- » The Net Zero Asset Managers Initiative, a group of 87 asset managers with $37 trillion under management, committed to achieving net-zero emissions by 2050.

- » The Net Zero Banking Alliance, which is composed of 43 global banks with over $28.5 trillion in assets, have made commitments to align portfolios with pathways to net zero by 2050.

We expect more financial institutions to commit to these initiatives in the run up to COP 26, creating significant momentum for the acceleration of a shift of capital away from greenhouse gas emitting activities that are not aligned with a net zero strategy.

Proliferation of net-zero pledges will increase cost of capital and reduce financing options for carbon intensive activities

Entities that have announced net-zero pledges

Sources: United Nations, Energy & Climate Intelligence Unit, Oxford University and Moody’s Investor Services

Companies under increasing pressure to respond

The breadth of climate policy initiatives across policy makers, prudential supervisors and providers of capital is changing the finance landscape for companies, increasing the likelihood that credible carbon transition plans will provide a greater differentiating factor

for credit strength. As an example, the UN Race to Zero initiative is seeking “breakthrough commitments” from key energy-related sectors, with an initial 20% emissions reduction target for each sector seen as the first step in transforming sectors. Company plans are expected to align with UN climate action pathways, which identify interim progress required to achieve net-zero emissions by 2050. More than 2,000 companies have already signed up, including a third of all FTSE 100-listed companies.

Large companies with high carbon exposure are under increasing shareholder pressure to respond to the net-zero policy and financial frameworks, with a net-zero target being a key demand of Climate Action 100+, the largest investor coalition on climate change. This also places pressure on other companies in their supply chain. For example, companies in extractive industries have been extending emissions reduction targets to include some scope 3 emissions from the use of their fossil-fuel products. This would require a structural shift to a post-growth strategy because reducing absolute emissions will require the sector to start producing less hydrocarbons.

Specific features of net-zero frameworks will determine extent and speed of credit impact

The growing list of net-zero targets demonstrates a clear direction of travel. But the underlying details can vary, especially when applied to individual corporate entities. The UN Race to Zero campaign has defined criteria for a net-zero commitment to be included under the Race to Zero umbrella. For example, some financial institutions have proposed calculating net zero at the portfolio level, which is less likely to deliver real world impact, as lending or investment to climate solutions is counted as offsetting continued high carbon exposure lending or investment. The resulting emissions cut are not likely to be as substantial as trying to drive each investment holding to net zero.

Definitions matter when interpreting net zero targets

Sources: Rogelj et al, “Three ways to improve net zero emissions targets,” Nature (2021) and Moody’s Investors Service

It is important to understand the assumptions around the use of offsets to determine the credit implications of each initiative and flow on impact for major emitters. If a target has limited scope and assumes significant offsets, then it will not require as significant a change in activities for the entity. At the country level, there has also been debate about the inclusion of non-domestic offsets to ensure against the double counting of benefits. Excessive reliance on greenhouse gases being absorbed by natural sinks or stored underground will undermine the validity and efficacy of targets.

Increasing disclosure requirements will increase scrutiny

Combined with emissions targets, the expected application of climate transparency requirements in major financial markets will open up fossil fuel exposure to greater scrutiny, further widening the gulf in the cost of/access to capital among companies based on the carbon intensity of their business.

For example the deployment of measures such as the EU Taxonomy and Sustainable Finance Disclosure Regulation is starting to have broad implications for the transparency of a range of financial actors, (see Sustainable Finance – Europe: Revised EU taxonomy expands criteria for funding energy efficient buildings, a credit positive and Asset Management – Europe: EU’s new sustainability disclosure rules will benefit asset managers). A number of financial regulators have committed to making Taskforce for Climate-related Financial Disclosures (TCFD) requirements mandatory for large or listed entities. The whole government approach of the Biden administration on climate change has already manifested itself in a new SEC Taskforce to review climate disclosures and the ESG claims of funds for any material gaps or misstatements.