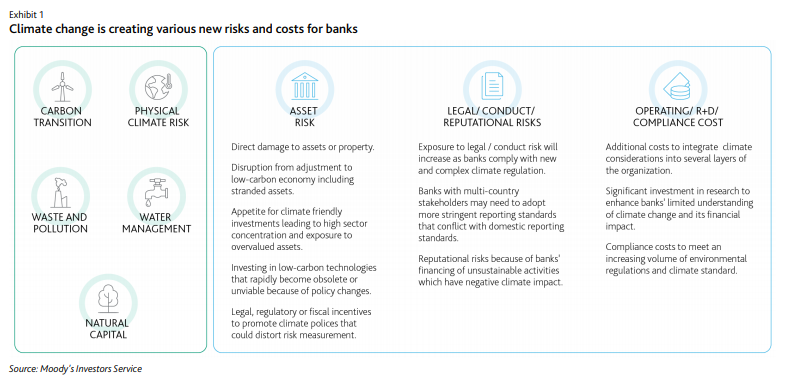

Moody’s has published a Sector In Depth “Banks – Asia-Pacific: Climate risks are growing, with large, diversified banks better positioned to cope”, indicating that climate change and related government policies expose Asia-Pacific banks to physical climate risks, as well as risks that stem from sudden changes in asset values as economic priorities shift. New standards and regulations will increase compliance costs for banks, while engaging in or facilitating activities with a significant negative environmental impact can inflict reputational damage on banks and tarnish their brands.

Key Takeaways

Summary Climate change and related government policies are posing various risks for banks in AsiaPacific. While climate change raises asset risks for banks, legal and reputational risks from it are growing. All Asia-Pacific banks are exposed to such risks but large, diversified banks in Singapore, Australia and Japan, along with major pan-Asia Pacific banks, are better positioned to cope with them and preserve their credit strength.

» Climate change and related government policies are adding an array of new risks for banks, both financial and reputational. These factors expose banks to physical climate risks as well as risks that stem from sudden changes in asset values as economic priorities shift. The need to fulfill new standards and regulations increases compliance costs for banks and exposes them to the risk of fines or litigation in the event of noncompliance. Engaging in activities with a significant negative environmental impact or facilitating them also can inflict reputational damage on banks and tarnish their brands.

» Climate change and related policies raise asset risks while legal and reputational risks are growing.Asia-Pacific economies with weak infrastructure are particularly vulnerable to physical climate risks, which can hurt banks’ asset quality because a natural disaster can damage borrowers’ assets or disrupt their cash flow. Many banks in the region also face asset risks from large exposures to sectors susceptible to carbon transitional risks. In addition, legal and reputational risks are increasing for banks in Asia-Pacific as governments advance guidelines and regulations for sustainable financing and disclosure requirements related to climate risks while investors are increasing pressure on businesses and banks to step up efforts to fight climate change.

» Large, diversified banks in developed economies are better prepared to cope with climate risks amid greater pressure from stakeholders to act. Fundamentally, their exposures are more diversified across different countries and industries, and this reduces their vulnerability to climate risks from a single location or borrower group. On top of that, they have proactively started incorporating climate factors into their strategic plans and operations as they face pressure from stakeholders to take steps early.

» Governments’ sustainable development goals will also create financing opportunities for banks.Bank lending will be the largest source of funding for clean energy projects that will require enormous amounts of investment.